Balancing production, revenue, and cash flow through advanced analytics

Balancing production, revenue, and cash flow

In large-scale mining operations, production optimization isn't just about maximizing output—it's about balancing multiple factors like cost, efficiency, and market conditions. CFT worked with a mining client to identify key drivers of performance using advanced data analytics.

The plant faced:

CFT applied a data-driven approach:

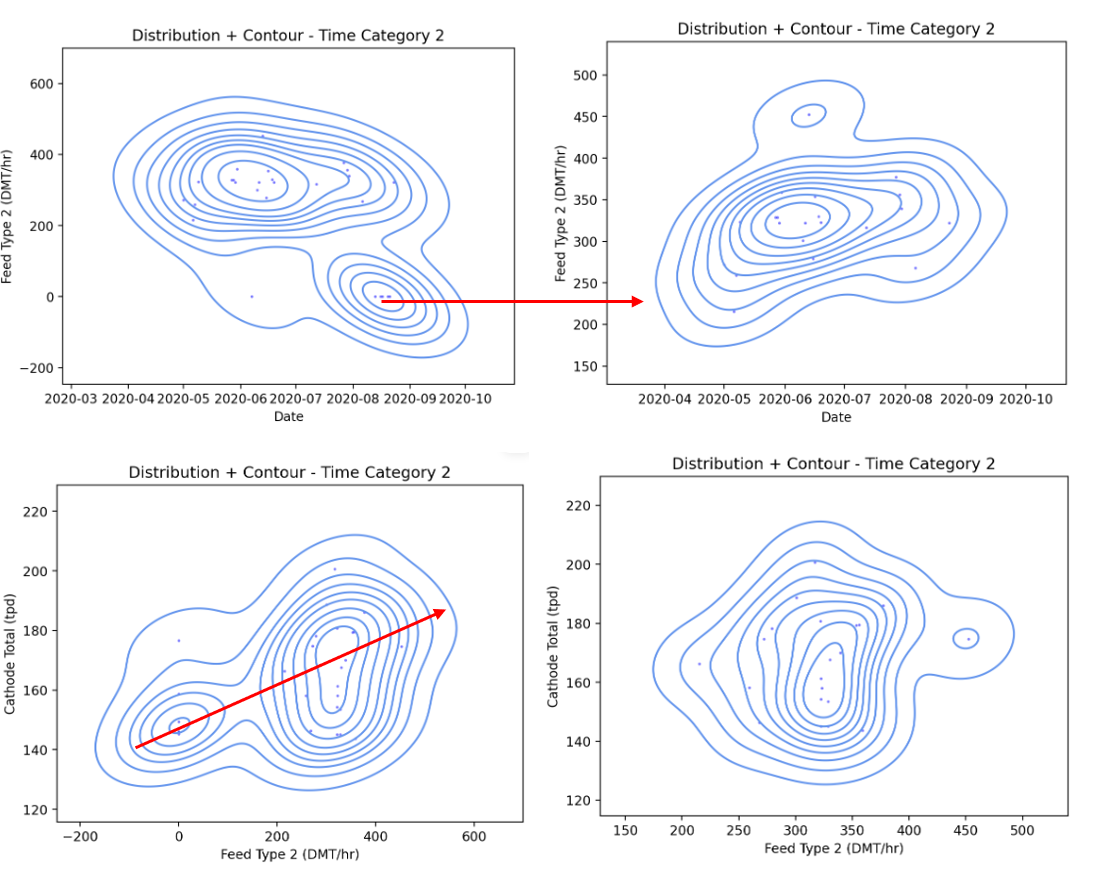

Removing negative feed rate data to ensure accurate analysis.

Identifying key relationships between feed types, acid consumption, and production rates.

Simulating operational strategies to align production with financial KPIs.

Distribution and contour analysis revealing key operational parameter relationships

Maximum copper and cobalt production rates occurred on different days, requiring strategic prioritization.

Acid consumption and wash efficiency were important, but mining factors had greater influence on outcomes.

Maximum revenue and maximum cash flow days did not align with production peaks, highlighting the need for dynamic operational adjustments.

| Day | Copper (tonnes) | Cobalt (tonnes) | Revenue ($000) | Cash Flow ($000) |

|---|---|---|---|---|

| Day 1 | 245.3 | 18.7 | 1,247 | 892 |

| Day 2 | 267.8 | 22.1 | 1,389 | 1,024 |

| Day 3 | 289.4 | 19.3 | 1,456 | 1,187 |

| Day 4 | 234.6 | 25.8 | 1,523 | 1,098 |

| Day 5 | 298.7 | 21.4 | 1,612 | 1,289 |

| Day 6 | 276.2 | 23.9 | 1,478 | 1,156 |

| Day 7 | 312.1 | 20.6 | 1,534 | 1,367 |

Analysis shows maximum copper production (Day 7: 312.1t) and maximum revenue (Day 5: $1,612k) occurred on different days, demonstrating the need for strategic optimization.

By adjusting operating parameters based on real-time data:

Advanced analytics empowers mining operations to move beyond simple production maximization, enabling data-driven decisions that balance output with financial performance.